A Hong Kong-based "creative accounting" researcher has upped the ante in its criticisms of agricultural property owner Rural Funds Group (ASX: RFF), following a review of FY19 financials lodged by responsible entity Rural Funds Management (RFM).

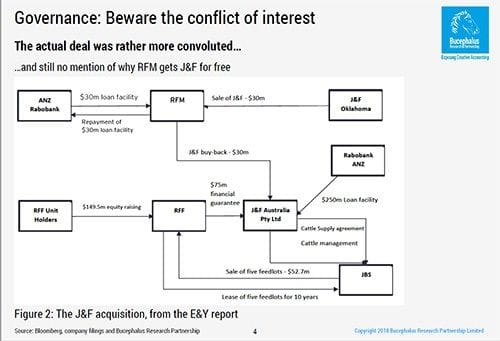

Bucephalus Research alleges filings made by RFM to the Australian Securities and Investments Commission (ASIC) demonstrate a "self dealing circularity" with RFF whereby rents are inflated, thus lifting property valuations and in turn, management fees paid to RFM.

The Hong Kong-headquartered firm, which has often been misrepresented as a short seller, previously alleged RFF was a "Ponzi scheme that could collapse at any time".

This came in the wake of short seller Bonitas Research's allegations of fraud and asset inflation at RFF, along with questions about the incentives arising from board member overlap at the agricultural property owner and its unlisted management company.

"In three out of four years, RFM farms lost money. Despite this, it pays disproportionately high rents to RFF," Bucephalus said in its latest report.

"It is these rents that boost valuations and ensure that RFF unitholders pay ever higher fees to RFM. It is easy to see how management benefits at unitholders expense.

"RFM loses money farming RFF assets. This is a concern because the group breached covenants in 2019, yet the unitholders are guaranteeing RFM's loans."

Bucephalus claims 52 per cent of rentals paid to RFF come from related parties, and it also alleges undisclosed related party transactions have taken place.

"RFM pays dividends based on revaluation, not cash, profits. This has left RFM highly levered and it would probably collapse without support from RFF," the group said.

"We suspect unitholders have no idea about the risk they have underwritten. The sale of the poultry operations confirms our valuation concerns, undermines recurring cashflow and illustrates the lack of care and maintenance investment."

Bucephalus Research managing partner Robert Medd (pictured) believes the poultry business sale corroborates his suspicions around RFF's property valuations.

"The gross revenue on the chickens was $25 million, and they were paying close to $11 million on rent. Well, no wonder they were struggling to actually break even," Medd tells Business News Australia.

He says the management company is in a position to decide how revenue is split between RFM and RFF as the landlord.

"What they've basically said is 'we want more money in the landlord, not in the farmer', and because they essentially left so little money for the farmer the RFP (Rural Funds Poultry) is now being shut down and wound up.

"What is also interesting, and which ties into my original argument, is that they say in the RFF that they actually not only repair and maintain their assets but they improve them, which is why they keep chucking the rents up.

"But they actually explicitly say with the poultry business that the sheds were at the end of their commercial life and it was going to cost them a lot of money to repair and maintain them."

Never miss a news update, subscribe here. Follow us on Facebook, LinkedIn, Instagram and Twitter.

Business News Australia

Get our daily business news

Sign up to our free email news updates.

)

)

)

)

)

)