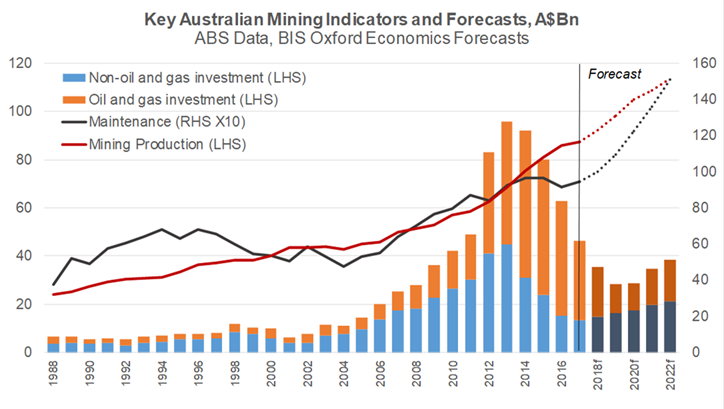

ACTIVITY in Australia's mining sector is set to accelerate in 2018 according to a recent report from BIS Oxford Economics.

The industry is poised to grow through 2018 and beyond, arguing well for exports and the broader Australian economy, with mining exploration, production, and maintenance are all expected to lift significantly through 2018.

Over the last year, mining production only grew by 2.5 per cent. BIS Oxford Economics anticipates the sector to grow by 5.5 per cent in 2017/18, with even stronger growth over the remainder of the decade.

The Mining in Australia 2017-2032 report bodes well for Australia, considering that the Adani Carmichael coal project was not taken into account, as BIS Oxford Economics says it is unlikely to go ahead.

Rubhen Jeya, BIS Oxford Economics Economist and report author says the massive investment into the sector will drive future growth.

"The enormous investment boom is now translating into production, particularly within oil and gas, where Australia is expected to become the leading LNG exporter by 2022," says Jeya.

Not only will mining production see a massive spurt of growth, but it will grow roughly double the pace of the national economy over the next five years, according to BIS.

The completion of a $200 billion wave of LNG projects over the coming year will see aggregate mining investment decline further over the next two years. However, Adrian Hart, Associate Director of Construction, Maintenance and Mining at BIS says the aggregate drop masks the start of a new cycle of investment across a range of commodities including copper, gold, coal and iron ore.

"The completion of Wheatstone, Ichthys and Prelude projects will subtract a further $20 billion in mining investment over the next two years," says Hart.

"But excluding oil and gas, mining investment elsewhere is expected to grow at a double-digit pace over 2017/18 and 2018/19 and will also continue to grow robustly through the subsequent three years."

Forecast strong, even with Adani Carmichael coal "unlikely to proceed"

Adani's $16 billion Cramichael coal project has been labelled as "unlikely to proceed" by BIS as it is too risky according to Hart.

"Given longer term steaming coal price projections, relatively high development costs, and risks to finance, this project is unlikely to proceed," says Hart.

Though the Adani project is unlikely to go ahead, Hart says its demise doesn't spell the end for Australian coal.

"There are other coal projects which have re-opened or been put back into development because of stronger coal prices compared to the trough in early 2016," says Hart.

"The outlook for coal remains positive, although prices may slip back a little in 2018."

Overall, the global economy remains a challenge for both miners and contractors who need to adjust to both global and domestic developments.

"How the global economy performs remains key," says Hart.

"While there are a range of risk factors looking ahead particularly regarding the US, China, UK and Eurozone economies global economic growth continues to reaccelerate and is expected to remain robust over the next few years."

Never miss a news update, subscribe here. Follow us on Facebook, LinkedIn, Instagram and Twitter.

Business News Australia

Get our daily business news

Sign up to our free email news updates.

)

)

)

)

)

)