In 2020, for the first time in Australia, more than half the shareholders of a public company voted in support of a climate change resolution put forward by shareholders in the face of opposition from the company’s board of directors.

The resolution, advanced at Woodside Petroleum’s annual general meeting, called for the company to establish hard targets to bring its own emissions and the emissions caused by the use of its products globally in line with the Paris Agreement to keep global warming below two degrees.

A similar resolution followed at this year’s AGL annual general meeting, gaining the support of 52% of the shareholders.

Although the Woodside vote was described as a “breakthrough moment”, it is part of an increase in shareholder activism around environmental, social and governance (ESG) issues that’s been building for several years.

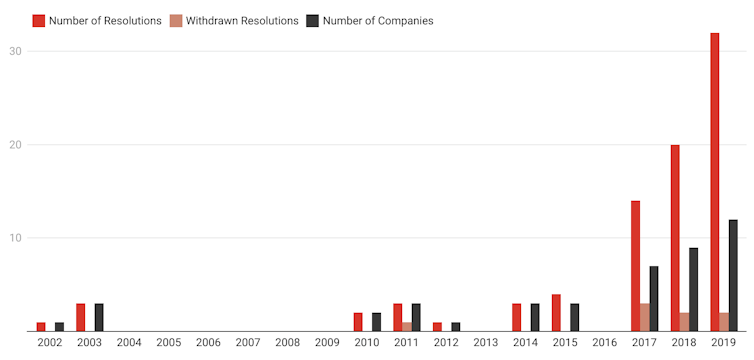

Our analysis of shareholder ESG resolutions put forward in listed Australian companies between 2002 and 2019 finds they have increased in number, prominence and impact.

Shareholder ESG Resolutions per year

A record 36 shareholder ESG resolutions were put forward in 2020. So far in 2021 a further 20 have been put forward, with more foreshadowed.

The resolutions have been concentrated in a small number of companies and industries.

Four industries – energy, banking, insurance and materials – accounted for 83.5% of the resolutions, with the 139 resolutions recorded between 2002 and the first part of 2021 concentrated in only 28 companies.

They were generally the companies most exposed to the risk of climate change or which provide finance to these companies.

More climate resolutions are succeeding

Several have been subjected to more than one campaign a year. The company with the most is Origin Energy, facing 24 resolutions in the last six years.

Of the 83 shareholder ESG resolutions advanced between 2002 and 2019, 48 concerned climate change. A further 26 notionally related to governance, but the governance resolutions were often the ones needed to enable consideration of issues such as climate change.

The others related to workers’ rights, human rights, obtaining the consent of Aboriginal native title holders to fracking activities, and gambling.

Almost all were proposed by just two groups: the Australasian Centre for Corporate Responsibility and Market Forces.

Until last year the level of support garnered by shareholder ESG resolutions was small, averaging 9.7%. In 2020, support jumped to 14.7%.

In 2021 to date it has climbed to 28%, bolstered by two resolutions of Rio Tinto shareholders that attracted 99% after winning the support of Rio Tinto’s board.

Success needn’t mean being put to a vote

Our study sought input from proponents of ESG resolutions, institutional shareholders, company directors, governance professionals and the Australian Securities and Investments Commission.

We found that winning votes isn’t the only objective of those who propose these resolutions.

Another is to get companies to respond positively even though the resolutions will be defeated, and sometimes in return for the resolutions being withdrawn before the annual general meeting.

As an example, the Australasian Centre for Corporate Responsibility submitted a resolution for this year’s Woodside annual general meeting calling on the company to prepare an annual climate report that would include Woodside’s strategy to reduce its greenhouse gas emissions and put the report to a shareholder advisory vote.

It withdrew the resolution after Woodside announced it would put climate reporting to an advisory vote of shareholders at its 2022 annual general meeting.

Some of those we interviewed said shareholder ESG resolutions distracted the companies from what they should be doing.

Others said they ran the risk of blurring the distinct roles of directors and shareholders. Many said the process for getting shareholder ESG resolutions on the agenda for annual general meetings is cumbersome.

However, almost all of those interviewed – and not just the proponents of the resolutions – saw them as a valuable way of letting companies know what their shareholders really think about how they should respond to the challenges of climate change and other issues.![]()

Ian Ramsay, Emeritus Professor, Melbourne Law School, The University of Melbourne and Lloyd Freeburn, Research Fellow, Centre for Corporate Law, Melbourne Law School, University of Melbourne, The University of Melbourne

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Get our daily business news

Sign up to our free email news updates.

)

)

)

)

)

)