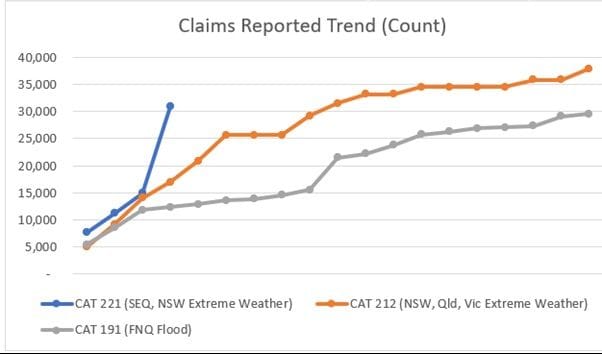

The rapidly unfolding flood crisis in Queensland and New South Wales has now led to 31,000 insurance claims nationwide, representing a 107 per cent spike over the course of one day.

There are currently 300,000 people subject to evacuation orders in Northern NSW where severe floods continue, while Queenslanders still have a long road to recovery despite the clear skies as floodwaters are still high in several waterways including the Brisbane River.

The Insurance Council of Australia (ICA) notes today's increase in claims is significantly higher than what was seen during last year's floods in NSW and QLD.

"Personal safety continues to be the number one priority, please follow the directions of the authorities," ICA CEO Andrew Hall said.

"This is still a large-scale unfolding event across two States with significant increases in claim numbers, and we expect this to continue to climb as people are allowed to return to their homes and businesses.

"Insurers are already on-the-ground helping with claims where it is safe to do so."

Hall noted that following the 2011 Brisbane floods, insurance policies now have standard flood definitions, and if policyholders have selected that cover this will include water that is released from a dam.

One of Australia's largest insurers IAG (ASX: IAG) reports that as of 5am today it had received 6,700 claims across its brands, of which 73 per cent were from NRMA. As of yesterday morning, Suncorp (ASX: SUN) had received 5,000 claims.

Get our daily business news

Sign up to our free email news updates.

)

)

)

)

)

)